Our solutions

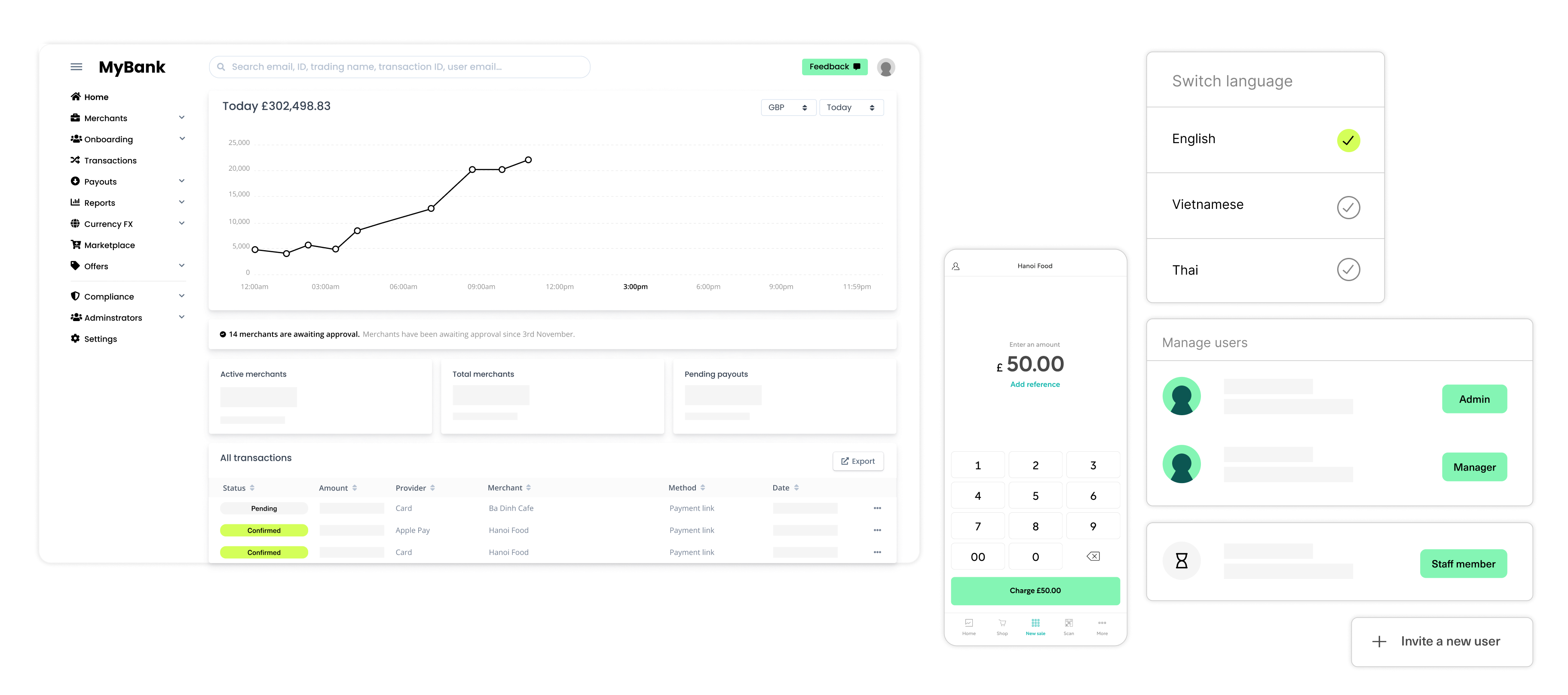

Pomelo provides financial institutions and enterprises with a unified payment platform solution to boost revenue and lower costs by increasing payment efficiencies across the financial ecosystem.

Drive revenue growth by streamlining your payment flows and merchant data through one platform for a fuller view of your financial ecosystem.

Make change work in your favour by using the latest technology such as blockchain, machine learning, cloud-based solutions, and more.

From banks to established enterprises, we design innovative solutions to solve real-world challenges across different industries.

Accelerate your revenue growth. Digitise and expand your base by offering your merchants, suppliers and end customers with more ways to pay, in just a few clicks.

Get more done with smarter workflows. Instant notifications and intelligent flows make merchant onboarding, transaction monitoring, chargeback and dispute management, and more, a breeze.

Grow your market share with the latest technology. Launch quickly with modular, easy to configure microservices and features. Let the tech do the heavy lifting.

Certified PCI DSS Level 1 Service Provider

Built on SOC2, ISO27001, ISO 27017 and NIST CSF-certified infrastructure

Certified PCI DSS Level 1 Service Provider, working to achieve SOC2 certification in 2022

Built on SOC2, ISO27001, ISO 27017 and NIST CSF-certified infrastructure

Team up with Pomelo - unlock opportunities and overcome real-world challenges with a unified platform for your financial technology needs.

Get in touch